Many, many authors have tried to call a bull market in platinum.

I'm going to call it now.

We have finally gotten to the point where Pt/Pd substitution makes sense.

This substitution will take awhile to occur. In the while, fundamental investors will provide support.

Some trades have the reputation of "widow makers." These are trades that seem to make sense from a value standpoint, but keep going the other way for years. Probably the best known one is shorting Japanese bonds, which has blown up some boldfaced hedge fund names. Going long platinum is another. A quick search through SA's archives will lead you to many long Pt calls, both outright and against Palladium (Pd) and Gold. So, I'm going to get into this soup as well. I am long April 2019 Pt futures, and plan to roll my position for maybe years. Here's why...

Background

Pt is an industrial metal. Its primary uses, as with most platinum-group metals, is as a catalyst for various chemical processes. These are in the chemical industry, the petroleum industry, and in the tailpipe of internal combustion engines. There are cheaper catalysts, but the platinum group is extremely good at catalysis. Moreover industry has gotten expert at thrifting the amount of Pt-group needed. For example, even a US-size car has only about six grams of Pt-group in its catalyst. At current prices and a Pd to Pt of 5:1, that's about $413 per car.

There's a fair bit of substitution possible among the metals. Gasoline engines used to use Pt-based catalysts, but manufactures moved to high percentages of Pd about 15 years ago. Pd was cheaper, and it's easier to control its byproduct reactions at high temperatures. Because of this it can be mounted closer to the engine, which improves performance. Pt is used more intensively in diesels. But they can be substituted.

A side note: about two years ago, I wrote a bullish article on Rhodium (Rh). Rh is needed to help catalyze oxides of nitrogen. It's on a tear, and I do not see where the needed Rh will come from. Could the world auto industry be stopped by a minor metal? It's possible.

There's also a residual demand for Pt in watches and jewelry and as a store of value. But Pt jewelry demand has been falling for years. The Asian consumer, who is about 80% of Pt jewelry demand (and most of the total luxury goods market at this point), is increasingly preferring gold. I would like to think that Pt will regain its old position as the "rich man's gold", but don't count on it.

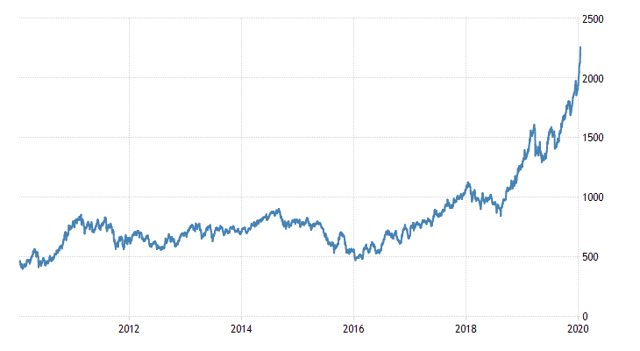

The long term chart of Pt is pretty depressing. Here's a ten year chart from tradingeconomics.com:

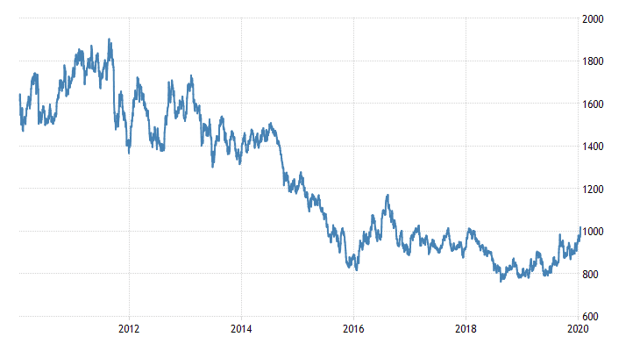

Even more amazing is how it has diverged from Pd. After all, one would think that substitutes would move together, at least over the long term. Not so:

Even more amazing is how it has diverged from Pd. After all, one would think that substitutes would move together, at least over the long term. Not so:Why I think the time is ripe

The Pt for Pd substitution argument has been around for awhile, and it hasn't happened. There are a number reasons for this:

- Until recently, Pd was only about $500 / oz. more than Pt. At six grams per car, that's only $96 per car.

- As mentioned, Pd works better at high temperatures.

- Pt is mined mostly in S. Africa and Russia. Much Pd is mined in N. America. This reduces the political risk.

- Changing catalysts is not just a matter of adding a new ingredient. A new converter has to be designed. A lot has changed in the last 15 years, and the old designs cannot be used. Since the auto industry is highly regulated, the new device will have to go through a long series of durability tests. There are legal issues relating to fires that the manufactures have to have confidence in protecting themselves against. Not something you can do in a few months. Think about a two year process.

But the recent blowoff in Pd has changed things. The difference is now $261 per car. So what can we look forward to. In the short term there is a possibility of slightly increasing the Pt/Pd ratio in diesel converters. But real change is still more than a year away.

This gets to the heart of the article. I am going to argue that the delay will not be a problem. Investors know about the long-term Pd shortage and are willing to make long-term bets on Pt.

One place you can see this is in commitments of traders in the futures market. Since July 2018, managed money has taken on over a 2.5 million oz. long position. Some of this is just CTAs following the recent minor uptrend, but the size makes me think there's more to it than that.

Another datum is the inflow into the main Pt ETF, PPLT. Over the past year, this has grown by $100 million, or 15%. Looking at all Pt ETFs, the increase in 2019 was .933 million oz. Since the price had been fairly steady until quite recently, I believe this is long-term patient money.

When will the deficit occur?

The platinum market has been in surplus for years. Here's a table from Johnson-Matthey on Pt supply/demand (2020 and 2022 are my forecasts). All data are in tonnes.

| 2016 | 2017 | 2018 | 2019 | 2020F |

2022F

| |

| Supply - Mine | 190 | 190 | 190 | 193 | 190 | 190 |

Supply - Recycling

| 60 | 64 | 65 | 69 | 68 | 70 |

| Supply - Total | 250 | 254 | 255 | 262 | 263 | 260 |

Demand - Total

| 258 | 252 | 243 | 265 | 265 | 300 |

| Of Which - Investor | 19 | 11 | 2 | 26 | 15 | 0 |

| Actual Use excl. Investor | 239 | 241 | 241 | 239 | 250 | 300 |

| Total Supply Minus Actual Use | 11 | 13 | 14 | 23 | 13 | (40) |

Looking at the last row, you see that Pt has been in surplus for a number of years. So what will be the increase in demand at current prices. Here's what I'm guesstimating:

- Autocatalysts used 295 tonnes of Pd in 2019. I believe that over a quarter of this could switch to Pt. That's 46 tonnes. I believe this switch is already underway.

- The chemical, electrical and dental industries used a total of 50 tonnes of Pd. Switching here is a little less practical, but let's say 10% or 5 tonnes.

- As I said above, I doubt that Pt jewelry will make a major comeback. However, it is at a sizable discount to gold. I have noticed that a number of watch manufactures have been issuing more Pt items. So I'll say that this decline will stop.

I also see little change in supply. Miners in S. Africa are obviously concentrating on Pd-heavy and Rh-heavy deposits. OTOH, there are some new mines that have Pt as a byproduct.

This gives a shortage in 2022, when the conversions have occurred, of 40 tonnes. More important, this will persist, at least until, or if, battery EVs take over the market.

One final fundamental. Some investors are hopeful that Pt-catalyzed fuel-cell cars and trucks will provide a new demand for Pt. I think it is highly unlikely. There simply isn't enough Pt for this. There may be some incremental demand from specialized machines like inner-city locomotives or indoor transportation, but it will be small.

How to Trade it

The Pt market has two conflicting features: a near-term oversupply and a long term shortage. At points in time, one or the other will be on investors' minds. So I expect a bumpy road up. I've got a long-term core position and a shorter term trading one. I'm also using futures rather than ETFs because of the tax treatment.

This brings me to another issue that needs mentioning. I am nowhere close to being a tax expert, but I do know that some Pt investment vehicles are taxed as collectibles. This is a higher rate than many readers pay. So inquire about this before you buy an investment. As always, this is not tax advice; it's just a head's up to find out about it for your situation.

Sometime in the next month, I will have access to updated supply/demand statistics. When I do, I'll publish an addendum.