I am not going to post further virus statistics. Another site https://www.worldometers.info/coronavirus/

has been expanded to include the information I was publishing as well as much else. It's a large site, so follow the links.

Adventures in trading, and hopefully educating readers. Note the disclaimer page on right.

Friday, February 21, 2020

Wednesday, February 19, 2020

More on Uber

I've gone through UBER's financials, and I think this is a stock play, not a bond play. Unlike Tesla, Uber seems to want to borrow on a regular basis. So If I'm wrong about the outlook for Uber, I can see a scenario where they issue more senior and secured debt. That would hit the existing bonds.

Nonetheless, I really like Uber's fundamentals and management.

I noticed on today's tape that Blue Apron is looking for a buyer or some other type of financing. They don't directly compete with Uber Eats, but there is an overlap. The fact that Softbank style investors are not willing to pour money into them is a good sign for those left standing.

Nonetheless, I really like Uber's fundamentals and management.

I noticed on today's tape that Blue Apron is looking for a buyer or some other type of financing. They don't directly compete with Uber Eats, but there is an overlap. The fact that Softbank style investors are not willing to pour money into them is a good sign for those left standing.

Tuesday, February 18, 2020

Uber

I'm thinking of buying UBER stock or bonds. The thesis is the same as it was for TSLA; the company has off-balance-sheet assets that would be valuable even in a bankruptcy. I haven't gone through the numbers, but here is the thesis.

For TSLA the assets were intellectual property and a number one market position. For UBER it's not as clear cut. They clearly do have a number one position. This makes a difference because of network effects. So they have more customers -> drivers get more fares -> more drivers -> customers have shorter wait times -> more customers.

I'm not really sure about the intellectual property...If it's only an app with central scheduling, well that would be easy for an Amazon to replicate. I know they spent big bucks on self-driving technology, but they are probably in last place here.

According to the new CEO, Uber Rides is currently profitable and will get more so. Uber Eats is still a loser, and faces substantial competition from low cost local companies. These local firms can employ cheap illegal immigrant deliverers which a public company cannot. Uber Freight is just getting going, but I think the network effects will be strong. A business will want to use an established corporation, with deep pockets, for its freight. So the locals are not a threat.

Uber also owns minority stakes in Didi (DIDI) in China, Yandex taxi (YNDX) in Russia and GrabTaxi (GRAB) in Southeast Asia. According to Uber, these are worth 11.8B. That's a good cushion for the bonds.

I'll go through the numbers in a later post. Right now, the bonds seem a great buy, and the stock maybe as well.

Monday, February 17, 2020

Main Page for Coronavirus Statistics

Feb. 19

Using mathematical modeling from data of both coronavirus and previous epidemics, the WHO estimates that the fatality rate is 0.3% to 1.0%. The reason this is lower than reported is that the model attempts to take into account mild cases that have not been reported.

Feb. 20

The Chinese keep changing the way they categorize various type of cases of the disease. They say that for now they are including all cases that are "suspected" of being covid-19. This is presumably why the number of reported cases has jumped today (1,676). As the patients get tested, they feel that some will be found to suffer from other ailments and taken out of this count. For the time being I am using the consistent series of confirmed cases.

For those who have just come: The Chinese policy appears to be: let the epidemic in Hubei burn itself out, but protect the rest of the country. This may be starting to work. Here's data from the WHO on new Chinese cases...

Confirmed Cases Only

Using mathematical modeling from data of both coronavirus and previous epidemics, the WHO estimates that the fatality rate is 0.3% to 1.0%. The reason this is lower than reported is that the model attempts to take into account mild cases that have not been reported.

Feb. 20

The Chinese keep changing the way they categorize various type of cases of the disease. They say that for now they are including all cases that are "suspected" of being covid-19. This is presumably why the number of reported cases has jumped today (1,676). As the patients get tested, they feel that some will be found to suffer from other ailments and taken out of this count. For the time being I am using the consistent series of confirmed cases.

For those who have just come: The Chinese policy appears to be: let the epidemic in Hubei burn itself out, but protect the rest of the country. This may be starting to work. Here's data from the WHO on new Chinese cases...

Confirmed Cases Only

| Hubei | total | ex-Hubei |

New Cases ex-Hubei

| |

| Feb 14 | 51986 | 63932 | 11946 | |

| Feb 15 | 54406 | 66576 | 12170 | 224 |

| Feb 16 | 56249 | 68584 | 12335 | 165 |

| Feb 17 | 58182 | 70635 | 12453 | 118 |

| Feb 18 | 59989 | 72528 | 12539 | 86 |

| Feb 19 | 61683 | 74280 | 12597 | 58 |

| Feb 20 | 62031 | 74675 | 12644 | 47 |

| Feb 21 | ||||

| Feb 22 | ||||

| Feb 23 | ||||

| Feb 24 | ||||

| Feb 25 | ||||

| Feb 26 | ||||

| Feb 27 |

Friday, February 14, 2020

Update on Tesla Bonds

Back in April 2019 I published a post on Tesla bonds. The thesis was that Tesla had large amounts of off-balance-sheet assets, mostly intellectual property. Although the financial situation of the company at the time was questionable, I felt that the bonds would be money good even in a potential bankruptcy. I bought the bonds for my personal account at about 87.

They are now trading for about 103. Not quite the run the stock has had LOL. Nonetheless, I am still holding on. The recent decision of Tesla to raise capital by issuing stock rather than debt makes them even more valuable. Nonetheless, I'm not adding since the upside is obviously not as great.

The basic thesis is still intact. Tesla makes the best electric cars in the world. The recent crop of German competitors falls short. What is Porsche thinking with a 250 mile range. Don't Porsche owners have weekend homes?

The technology of electric cars will continue to advance over the next five years or so. Eventually they will become a stable technology, and costs and marketing will take over. By then Tesla will be hard to unseat.

They are now trading for about 103. Not quite the run the stock has had LOL. Nonetheless, I am still holding on. The recent decision of Tesla to raise capital by issuing stock rather than debt makes them even more valuable. Nonetheless, I'm not adding since the upside is obviously not as great.

The basic thesis is still intact. Tesla makes the best electric cars in the world. The recent crop of German competitors falls short. What is Porsche thinking with a 250 mile range. Don't Porsche owners have weekend homes?

The technology of electric cars will continue to advance over the next five years or so. Eventually they will become a stable technology, and costs and marketing will take over. By then Tesla will be hard to unseat.

Thursday, February 13, 2020

Coronavirus Data

On Feb13 the Chinese authorities changed the way they report Coronavirus cases. Previously they had reported only laboratory-confirmed cases. They have now switched to including clinically-diagnosed cases as well. This increased the number of cases by about 15K. This new increased number was reported in most of the mainstream media, with or without the explanation. For the sake of consistency, I am continuing to report and analyze the laboratory-confirmed cases at:

https://thecommoditystrategist.blogspot.com/2020/02/is-coronavirus-burning-itself-out.html

https://thecommoditystrategist.blogspot.com/2020/02/is-coronavirus-burning-itself-out.html

Monday, February 10, 2020

More on Coronavirus

I plan on updating the table from the previous post daily. So check back at https://thecommoditystrategist.blogspot.com/2020/02/is-coronavirus-burning-itself-out.html to see the new data.

This is usually updated late afternoon New York time.

This is usually updated late afternoon New York time.

Is the Coronavirus Burning Itself Out?

This data is now being updated in the post "New Coronavirus Statistics."

This data is no longer updated...

The Chinese policy appears to be: let the epidemic in Hubei burn itself out, but protect the rest of the country. This may be starting to work. Here's data from the WHO on new Chinese cases...

The Chinese government is now reporting clinically diagnosed as well as laboratory diagnosed cases. However, it appears that all the cases ex-Hubei are laboratory diagnosed. Therefore this table, which is laboratory only, probably gives an OK estimate of the trend.

| Hubei | total | ex-Hubei |

New Cases ex-Hubei

| |

| Feb 1 | 7153 | 11821 | 4668 | |

| Feb 2 | 9074 | 14411 | 5337 | 669 |

| Feb 3 | 11177 | 17238 | 6061 | 724 |

| Feb 4 | 13522 | 20471 | 6949 | 888 |

| Feb 5 | 16678 | 24363 | 7685 | 736 |

| Feb 6 | 19665 | 28060 | 8395 | 710 |

| Feb 7 | 22112 | 31211 | 9099 | 704 |

| Feb 8 | 24953 | 34598 | 9645 | 546 |

| Feb 9 | 27100 | 37251 | 10151 | 506 |

| Feb 10 | 29631 | 40235 | 10604 | 453 |

| Feb 11 | 31728 | 42708 | 10980 | 296 |

| Feb 12 | 33366 | 44730 | 11364 | 384 |

| Feb 13 | 34874 | 46550 | 11675 | 311 |

| Feb 14 | 36602 | 48548 | 11946 | 275 |

| Feb 15 | 37884 | 50054 | 12170 | 224 |

| Feb 16 | 38839 | 51174 | 12335 | 165 |

If the trend ex-Hubei can continue, we may be coming to the end. Of course, if the epidemic spreads to other countries, all bets are off.

Sunday, January 26, 2020

Summary

Many, many authors have tried to call a bull market in platinum.

I'm going to call it now.

We have finally gotten to the point where Pt/Pd substitution makes sense.

This substitution will take awhile to occur. In the while, fundamental investors will provide support.

Some trades have the reputation of "widow makers." These are trades that seem to make sense from a value standpoint, but keep going the other way for years. Probably the best known one is shorting Japanese bonds, which has blown up some boldfaced hedge fund names. Going long platinum is another. A quick search through SA's archives will lead you to many long Pt calls, both outright and against Palladium (Pd) and Gold. So, I'm going to get into this soup as well. I am long April 2019 Pt futures, and plan to roll my position for maybe years. Here's why...

Background

Pt is an industrial metal. Its primary uses, as with most platinum-group metals, is as a catalyst for various chemical processes. These are in the chemical industry, the petroleum industry, and in the tailpipe of internal combustion engines. There are cheaper catalysts, but the platinum group is extremely good at catalysis. Moreover industry has gotten expert at thrifting the amount of Pt-group needed. For example, even a US-size car has only about six grams of Pt-group in its catalyst. At current prices and a Pd to Pt of 5:1, that's about $413 per car.

There's a fair bit of substitution possible among the metals. Gasoline engines used to use Pt-based catalysts, but manufactures moved to high percentages of Pd about 15 years ago. Pd was cheaper, and it's easier to control its byproduct reactions at high temperatures. Because of this it can be mounted closer to the engine, which improves performance. Pt is used more intensively in diesels. But they can be substituted.

A side note: about two years ago, I wrote a bullish article on Rhodium (Rh). Rh is needed to help catalyze oxides of nitrogen. It's on a tear, and I do not see where the needed Rh will come from. Could the world auto industry be stopped by a minor metal? It's possible.

There's also a residual demand for Pt in watches and jewelry and as a store of value. But Pt jewelry demand has been falling for years. The Asian consumer, who is about 80% of Pt jewelry demand (and most of the total luxury goods market at this point), is increasingly preferring gold. I would like to think that Pt will regain its old position as the "rich man's gold", but don't count on it.

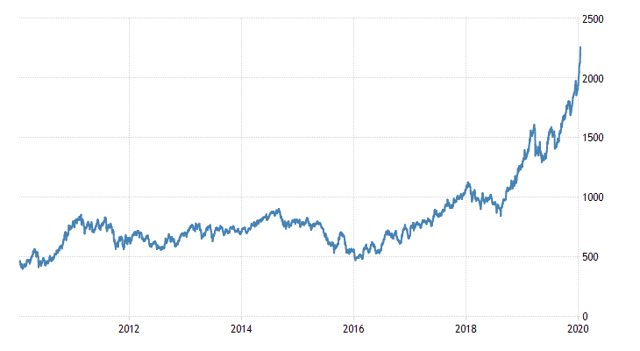

The long term chart of Pt is pretty depressing. Here's a ten year chart from tradingeconomics.com:

Even more amazing is how it has diverged from Pd. After all, one would think that substitutes would move together, at least over the long term. Not so:

Even more amazing is how it has diverged from Pd. After all, one would think that substitutes would move together, at least over the long term. Not so:Why I think the time is ripe

The Pt for Pd substitution argument has been around for awhile, and it hasn't happened. There are a number reasons for this:

- Until recently, Pd was only about $500 / oz. more than Pt. At six grams per car, that's only $96 per car.

- As mentioned, Pd works better at high temperatures.

- Pt is mined mostly in S. Africa and Russia. Much Pd is mined in N. America. This reduces the political risk.

- Changing catalysts is not just a matter of adding a new ingredient. A new converter has to be designed. A lot has changed in the last 15 years, and the old designs cannot be used. Since the auto industry is highly regulated, the new device will have to go through a long series of durability tests. There are legal issues relating to fires that the manufactures have to have confidence in protecting themselves against. Not something you can do in a few months. Think about a two year process.

But the recent blowoff in Pd has changed things. The difference is now $261 per car. So what can we look forward to. In the short term there is a possibility of slightly increasing the Pt/Pd ratio in diesel converters. But real change is still more than a year away.

This gets to the heart of the article. I am going to argue that the delay will not be a problem. Investors know about the long-term Pd shortage and are willing to make long-term bets on Pt.

One place you can see this is in commitments of traders in the futures market. Since July 2018, managed money has taken on over a 2.5 million oz. long position. Some of this is just CTAs following the recent minor uptrend, but the size makes me think there's more to it than that.

Another datum is the inflow into the main Pt ETF, PPLT. Over the past year, this has grown by $100 million, or 15%. Looking at all Pt ETFs, the increase in 2019 was .933 million oz. Since the price had been fairly steady until quite recently, I believe this is long-term patient money.

When will the deficit occur?

The platinum market has been in surplus for years. Here's a table from Johnson-Matthey on Pt supply/demand (2020 and 2022 are my forecasts). All data are in tonnes.

| 2016 | 2017 | 2018 | 2019 | 2020F |

2022F

| |

| Supply - Mine | 190 | 190 | 190 | 193 | 190 | 190 |

Supply - Recycling

| 60 | 64 | 65 | 69 | 68 | 70 |

| Supply - Total | 250 | 254 | 255 | 262 | 263 | 260 |

Demand - Total

| 258 | 252 | 243 | 265 | 265 | 300 |

| Of Which - Investor | 19 | 11 | 2 | 26 | 15 | 0 |

| Actual Use excl. Investor | 239 | 241 | 241 | 239 | 250 | 300 |

| Total Supply Minus Actual Use | 11 | 13 | 14 | 23 | 13 | (40) |

Looking at the last row, you see that Pt has been in surplus for a number of years. So what will be the increase in demand at current prices. Here's what I'm guesstimating:

- Autocatalysts used 295 tonnes of Pd in 2019. I believe that over a quarter of this could switch to Pt. That's 46 tonnes. I believe this switch is already underway.

- The chemical, electrical and dental industries used a total of 50 tonnes of Pd. Switching here is a little less practical, but let's say 10% or 5 tonnes.

- As I said above, I doubt that Pt jewelry will make a major comeback. However, it is at a sizable discount to gold. I have noticed that a number of watch manufactures have been issuing more Pt items. So I'll say that this decline will stop.

I also see little change in supply. Miners in S. Africa are obviously concentrating on Pd-heavy and Rh-heavy deposits. OTOH, there are some new mines that have Pt as a byproduct.

This gives a shortage in 2022, when the conversions have occurred, of 40 tonnes. More important, this will persist, at least until, or if, battery EVs take over the market.

One final fundamental. Some investors are hopeful that Pt-catalyzed fuel-cell cars and trucks will provide a new demand for Pt. I think it is highly unlikely. There simply isn't enough Pt for this. There may be some incremental demand from specialized machines like inner-city locomotives or indoor transportation, but it will be small.

How to Trade it

The Pt market has two conflicting features: a near-term oversupply and a long term shortage. At points in time, one or the other will be on investors' minds. So I expect a bumpy road up. I've got a long-term core position and a shorter term trading one. I'm also using futures rather than ETFs because of the tax treatment.

This brings me to another issue that needs mentioning. I am nowhere close to being a tax expert, but I do know that some Pt investment vehicles are taxed as collectibles. This is a higher rate than many readers pay. So inquire about this before you buy an investment. As always, this is not tax advice; it's just a head's up to find out about it for your situation.

Sometime in the next month, I will have access to updated supply/demand statistics. When I do, I'll publish an addendum.

Subscribe to:

Comments (Atom)