I wrote an article for Seeking Alpha on why I think the bottom of the commodity cycle has been made. Before I go into the substance of it, remember that just being bullish doesn't make for a trade. You have to have a risk/reward setup that meets your objectives. I believe that commodities will not run back to 2014 levels quickly. Instead I expect an upward sloping trading range that will give numerous points to take intermediate profits. Along that line, I wrote Nov 2016 Soybean 12 calls against my long 10 call position. If the market dips, I'll add back.

Commodities are Cheap

Here is a graph that I used in the first post of this blog. It graphs a commodity index over time in both nominal terms and adjusted by the US consumer price index and the value of the US dollar. If you were reading the blog at that time you may remember that I use the IMF commodity index as a base and splice it back to 1947 with the US PPI for crude materials.

The commodity index on a deflated basis is actually getting close to the lows of the late '90s. Now it is well known that over time commodity prices tend to fall relative to other prices. (I know the "sustainability" guys don't want to believe this, but just look at the graph!) Nonetheless, the situation in the late 90s was truly extreme. We had a major crisis in emerging markets, the major commodity demand growth area. We also had a huge flow of funds from what was then called the old economy into the dotcom stuff. I thought that commodities were undervalued then, and we are very close to that now.

Oil Prices

Energy is the most important commodity group on the board. Not only is it the largest by dollar value, but it serves as an input to everything else. If you want to get physics class philosophical, you can say that energy is even more basic than food. And energy prices are dominated by oil. Readers of this blog know that I think that oil prices will slowly rise over the next few years (And I am painfully aware that I am still somewhat behind on a long Dec 2018 crude trade). This will boost the cost of production for everything else. BTW it is not true that declining natural gas prices will compensate for this. Worldwide, oil is much bigger than gas. In fact the increased use of gas is mostly displacing coal, so overall energy prices are not falling.

The Lags are Long but not that Long

The reason that the commodity "cobweb" price/volume pattern repeats itself is that there are long lags in both the production and consumption of commodities. Over the short run elasticity is very low; over the long run it's much higher. It takes only a year to turn around production of row crops and poultry. It takes two years for pork. Maybe three to five for cattle. Maybe five to ten for for mined metals. We are now about four and a half years into the downcycle. Most of the decline has been in the past two years. My feeling is that we should start seeing the both supply and demand responses very soon. These are clearly happening in energy, and somewhat happening in metals.

The Last few Years have been Lucky

This blog has poo-pooed the climate change and sustainability scaremongers many times. Simply put, humans will find a way to cope and thrive. We are not going to run out of anything important to improving the quality of life on earth. Nonetheless, the agricultural situation of the last three years has been exceptional. Here's a graph of total world grain yield. Note how exceptional the last three years have been.

The long term trend is up, true. But the markets have gotten used to bumper crops. Consumers are complacent, and the fast money is short. I believe the ags in particular are ripe for a major rip.

Refer to a post of about a month ago in which I gave a table of years in which the ENSO index declined. This is one of those years.

Emerging Market Economies will not Stay Down Forever

Last year I wrote a sour post on the disaster in EM. In retrospect I was probably too cynical. It's true that most EMs wasted a great chance to diversify and reform their economies. But that's a cyclical problem. Longer term, most of them are still growing, and will likely resume higher growth when the financial flows revert. Hopefully some of them have learned their lesson, and will use future inflows for infrastructure rather than current consumption or corruption. Infrastructure is heavily commodity intensive.

Adventures in trading, and hopefully educating readers. Note the disclaimer page on right.

Wednesday, March 23, 2016

Monday, March 14, 2016

Error

A reader called me to say I made a mistake in Friday's post. I had said that the volatilities on BTU were elevated because there weren't enough shares to short. So I wrote calls on BTU against my long bond position.

This was wrong. Only the puts have elevated volatility. The call volatility, at about 230%, is actually right in line with the 25-day historical vol. If you can find shares to short, there's a nice conversion arbitrage.

Even with this, I still like the overall position. If the bonds are worth almost nothing, the stock should be worth absolutely nothing.

This was wrong. Only the puts have elevated volatility. The call volatility, at about 230%, is actually right in line with the 25-day historical vol. If you can find shares to short, there's a nice conversion arbitrage.

Even with this, I still like the overall position. If the bonds are worth almost nothing, the stock should be worth absolutely nothing.

Saturday, March 12, 2016

Peabody Energy Follow-Up

The lottery ticket on BTU has worked pretty quickly. Prices are all over the place on this near-

Chapter 11 bond, but I think the offer has gone up to about 7 1/2. I wrote some calls on BTU equity against the position. The logic in this trade is very strong; if the bonds are worth almost nothing, the stock should be worth absolutely nothing. However, there are only a limited number of shares available to short. When this happens, people resort to buying options, and vols go up. The vol of the calls is about 230%; the puts about 300%!

Additionally, rumor has it that there is a big fund with an existing long bond/short equity trade. He is already sucking wind, and may be forced to blow out. We will see.

Chapter 11 bond, but I think the offer has gone up to about 7 1/2. I wrote some calls on BTU equity against the position. The logic in this trade is very strong; if the bonds are worth almost nothing, the stock should be worth absolutely nothing. However, there are only a limited number of shares available to short. When this happens, people resort to buying options, and vols go up. The vol of the calls is about 230%; the puts about 300%!

Additionally, rumor has it that there is a big fund with an existing long bond/short equity trade. He is already sucking wind, and may be forced to blow out. We will see.

Wednesday, March 9, 2016

A Lottery Ticket on Coal - not by Shirley Jackson

I used to buy a lot of what traders call lottery tickets: trades with a low probability of success but extremely high potential payoffs. The best commodity trade I ever made was buying long dated $100 crude calls in 2008. It was about a 25 bagger. Thats what can happen with a lottery ticket.

I haven't found many of these recently, but I did one a few days ago. I bought the Peabody Coal (BTU) 6% coupon bond due in 2018 for 5 cents on the dollar. I went through a retail broker, since I trade so few bonds. If you have access to the wholesale market, I think you can get it even cheaper.

BTU looks like a clear bankruptcy situation. Moreover there is a lot of debt ahead of my bond on the seniority ladder. My argument is that the situation is so bad that the lenders may work with the company to extend and pretend. Even buying some time might make this trade work.

I don't really follow coal to closely, but it's hard to see much help from the commodity front. Natgas is still a better alternative for almost all electricity generation, and it keeps getting cheaper all the time. A hot summer might change that, if el Nino doesn't peter out. Longer term, I see slowly rising overall energy prices, but it's too long term to bail out BTU. So in all likelihood, I will lose 100% on the trade. That's what usually happens with lottery tickets.

I haven't found many of these recently, but I did one a few days ago. I bought the Peabody Coal (BTU) 6% coupon bond due in 2018 for 5 cents on the dollar. I went through a retail broker, since I trade so few bonds. If you have access to the wholesale market, I think you can get it even cheaper.

BTU looks like a clear bankruptcy situation. Moreover there is a lot of debt ahead of my bond on the seniority ladder. My argument is that the situation is so bad that the lenders may work with the company to extend and pretend. Even buying some time might make this trade work.

I don't really follow coal to closely, but it's hard to see much help from the commodity front. Natgas is still a better alternative for almost all electricity generation, and it keeps getting cheaper all the time. A hot summer might change that, if el Nino doesn't peter out. Longer term, I see slowly rising overall energy prices, but it's too long term to bail out BTU. So in all likelihood, I will lose 100% on the trade. That's what usually happens with lottery tickets.

Friday, March 4, 2016

Nickel

I have been hinting about going long nickel in several posts. I've now actually done it.

Undervaluation The ten-year graphs on this site forecast that nickel will double in real terms in ten years. That's a pretty good starting point. Nickel is the most undervalued metal I follow. BTW, there is a good reason for this. Back a few years ago, when China was frantically buying every metal in sight, Indonesia enacted an embargo on nickel ore exports. Their objective was to force local processing of the ore. Because many believed that Indonesia could not build the necessary processing facilities quickly enough, this created a panic in the market. Nickel went to absurdly high prices. This led to more production, and the typical commodity "cobweb" ensued. I think we are now at the opposite end of the cycle.

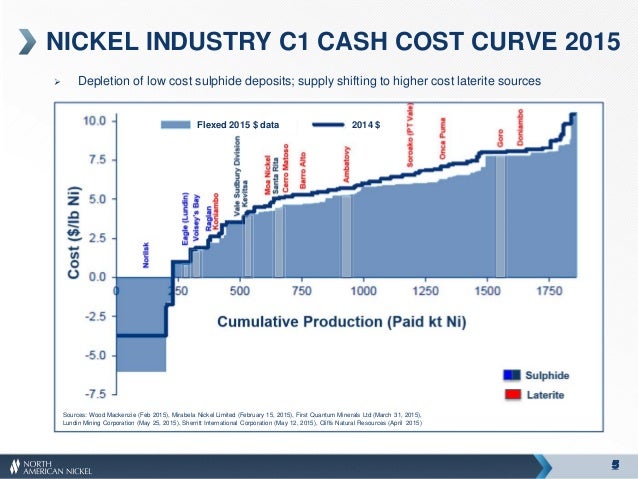

Nickel now sells for about $4 per lb. The graph below gives the cost curve. Most production is now losing money. BTW, the negative costs for Norislk (NILSY) is not an error. Norilsk produces so much coproduct metals that it more than covers their production costs. More on that later.

The fact that these miners are losing money does not mean they will shut down production immediately. Current prices may well cover their cash production costs. Also, some production is going to be subsidised. For example, France said last month that it would subsidise the nickel industry in New Caledonia, which had previously been expected to reduce production. Another issue is that the value of the Indonesian Rupiah has fallen by about half. This reduces the cost curve.

Nonetheless, the main thrust of this blog is to think strategically. All the above risks are short to intermediate term. In due time production will be shut down, and prices will rise. The remaining producers wind up doing very well. This is a three year trade.

So how to play this. Normally for longer term trades, I like to invest in the equity or debt of the lowest cost tradable producer. That would be Norilsk. For more on Norilsk's fundamentals, see the excellent Seeking Alpha article

http://seekingalpha.com/article/3940446-norilsk-nickel-worlds-largest-nickel-palladium-producer-significantly-undervalued

My numbers are slightly different from his, but only marginally. Also note that Norilsk also produces other metals, particularly copper and palladium. These revenues combined are actually larger than from nickel. I am a little bullish on palladium and a little bearish on copper.

In this case, however, I also bought LME nickel. The total return from this I estimate at 10% - 15% per year unlevered (I am unlevered). It's also easily tradable. More important, it does not have the Russian country risk. Now I personally feel that the Russian situation is not as bad as the market thinks, and its market is undervalued. But I could easily be wrong here. So keep that in mind if you follow me into Norilsk.

Undervaluation The ten-year graphs on this site forecast that nickel will double in real terms in ten years. That's a pretty good starting point. Nickel is the most undervalued metal I follow. BTW, there is a good reason for this. Back a few years ago, when China was frantically buying every metal in sight, Indonesia enacted an embargo on nickel ore exports. Their objective was to force local processing of the ore. Because many believed that Indonesia could not build the necessary processing facilities quickly enough, this created a panic in the market. Nickel went to absurdly high prices. This led to more production, and the typical commodity "cobweb" ensued. I think we are now at the opposite end of the cycle.

Nickel now sells for about $4 per lb. The graph below gives the cost curve. Most production is now losing money. BTW, the negative costs for Norislk (NILSY) is not an error. Norilsk produces so much coproduct metals that it more than covers their production costs. More on that later.

The fact that these miners are losing money does not mean they will shut down production immediately. Current prices may well cover their cash production costs. Also, some production is going to be subsidised. For example, France said last month that it would subsidise the nickel industry in New Caledonia, which had previously been expected to reduce production. Another issue is that the value of the Indonesian Rupiah has fallen by about half. This reduces the cost curve.

Nonetheless, the main thrust of this blog is to think strategically. All the above risks are short to intermediate term. In due time production will be shut down, and prices will rise. The remaining producers wind up doing very well. This is a three year trade.

So how to play this. Normally for longer term trades, I like to invest in the equity or debt of the lowest cost tradable producer. That would be Norilsk. For more on Norilsk's fundamentals, see the excellent Seeking Alpha article

http://seekingalpha.com/article/3940446-norilsk-nickel-worlds-largest-nickel-palladium-producer-significantly-undervalued

My numbers are slightly different from his, but only marginally. Also note that Norilsk also produces other metals, particularly copper and palladium. These revenues combined are actually larger than from nickel. I am a little bullish on palladium and a little bearish on copper.

In this case, however, I also bought LME nickel. The total return from this I estimate at 10% - 15% per year unlevered (I am unlevered). It's also easily tradable. More important, it does not have the Russian country risk. Now I personally feel that the Russian situation is not as bad as the market thinks, and its market is undervalued. But I could easily be wrong here. So keep that in mind if you follow me into Norilsk.

Subscribe to:

Posts (Atom)